Marty Levine

August 15, 2021

The rich get richer and the rest of us get ignored. That’s the disturbing theme that emerges from three stories that appeared in my in-box last week. Each story was published as debate raged over our ability to pay for needed investments in our national safety net and the world struggles to get vaccines in every arm.

The Conversation published a story that put more evidence behind a conclusion that has seemed obvious for some time, “Forget the American Dream – millions of working Americans still can’t afford food and rent.” Its authors, Jeffrey Kucik, (Assistant Professor of Political Science, University of Arizona) and Don Leonard (Assistant Professor of Practice in City and Regional Planning, The Ohio State University) used data from AdvisorSmith along with MIT’s Living Wage Calculator to estimate the real living wage, the amount of money needed to meet basic life needs, for more than 500 metropolitan areas from coast to coast.

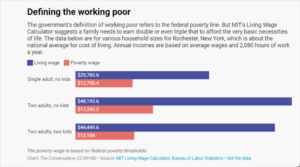

Kucik and Leonard, we find policymakers and conservative advocates focused on a distorted picture of how we live our lives, a picture that hides the need to act. Public policy is created using the Federal Poverty Guideline, which “drastically understates the scope of the working poor because the federal poverty line is unrealistically low – only $12,880 for an individual. The official poverty line was created to determine eligibility for Medicaid and other government benefits that support low-income people, not to indicate how much a person needs to actually get by.”

Kucik and Leonard, using a clearer lens find that “it takes…about $30,000 a year for a single person without dependents in the average city – a little less in some cities, and much, much more for families and anyone who lives in a major city …the lowest cost of living in Beckley, West Virginia …a childless worker…needs to earn about $28,200 to make essential ends meet… the average American city has a cost of living of around $30,000 a year for a single person. Of course, costs add up quickly for households with more than one person. Two adults …need over $48,000 a year, while a single parent with one child needs more than $63,000. In San Francisco, a single parent would need to earn $101,000 a year just to scrape by.”

Using this as their yardstick, the authors “estimate that at least 27 million U.S. workers don’t earn enough to hit that very low threshold of $30,000, based on the latest occupation wage data from the Bureau of Labor Statistics, a government agency, from May 2020. We believe this is a conservative estimate and that the number of people with jobs who earn less than what’s necessary to afford the necessities of life is likely much higher.”

Even with the recent indicators that the high demand for labor in these post-pandemic months showing us that hourly wages have gone up, their analysis remains important. Yes, more jobs are now paying as much as $15/hour. But that still leaves many still underwater, forced to work a second job and just one emergency away from being homeless.

The ongoing debates about the minimum wage, the need for a universal guaranteed income, affordable housing, and universal health care all ignore the real world we all live in. Using a measure that ignores the price of milk and the real cost of hou9sing the nation can ignore the poor and the near-poor. We can do nothing while the poor, even those who work from morning until night, get poorer.

While The Conversation was focusing our attention on the working poor, ProPublica shared more of what it learned from a treasure trove of leaked Internal Revenue Service documents that spotlighted how rigged our supposedly progressive tax system is: “Secret IRS Files Reveal How Much the Ultrawealthy Gained by Shaping Trump’s ‘Big, Beautiful Tax Cut’” This is a story how the political power that great wealth brings was deployed. This is a story of why in the wealthiest nation in the world we govern as if we have no ability to invest in protecting the health and welfare of everyone.

The Tax Cuts and Jobs Act was a central objective of the Trump Administration. Even during the economic havoc of the pandemic, Republican legislators have strongly resisted any suggestions that it should be modified to help pay for needed government spending. ProPublica’s story pulled back the curtains on how it was developed with an eye on benefitting the rich and powerful and not with an eye on helping government do the work of the people.

According to ProPublica, “it was crafted largely in secret by a handful of Trump administration officials and members of Congress [and]rushed through the legislative process. As the draft language of the bill made its way through Congress, lawmakers friendly to billionaires and their lobbyists were able to nip and tuck and stretch the bill to accommodate a variety of special groups. The flurry of midnight deals and last-minute insertions of language resulted in a vast redistribution of wealth into the pockets of a select set of families, siphoning away billions in tax revenue from the nation’s coffers.”

With just one change in the Federal Tax Code,“82 ultrawealthy households collectively walked away with more than $1 billion in total savings, an analysis of confidential tax records shows. Republican and Democratic tycoons alike saw their tax bills chopped by tens of millions, among them:

While digesting the inside story of how the wealthy were able to protect their wealth consider the Institute for Policy Studies recently released report, “Global Billionaires See $5.5 Trillion Pandemic Wealth Surge” which details how profitable these pandemic has turned out for the nation’s and the world’s wealthiest men and women.

Using data compiled by Forbes, IPS found that “the world’s billionaires have seen their wealth surge by over $5.5 trillion since the beginning of the pandemic in March 2020, a gain of over 68 percent. The world’s 2,690 global billionaires saw their combined wealth rise from $8 trillion on March 18, 2020, to $13.5 trillion as of July 31, 2021… Global billionaire total wealth has increased more over the past 17 months of the pandemic than it did in the 15 years prior to the pandemic. Between 2006 and 2020, global billionaire wealth increased from $2.65 trillion to $8 trillion, a gain of $5.35 trillion.”

Leading the pack was the world’s richest man, Jeff Bezos, whose “wealth increased by $79.4 billion during the pandemic, rising from $113 billion in March 2020 to $192.4 billion on July 31, 2021. An estimated 325 new billionaires joined the ‘3-comma club’ since the pandemic began ―equivalent to roughly one new billionaire minted every day.”

So, the rich do get richer, even while we live through terrible times. The rich have the power to shape the system for their benefit, often because of the immense political power that their wealth provides. And the struggles of millions of men, women, and children can be erased by controlling how we define the basic facts of life.

Policymakers and politicians cannot get captured by a perspective that hides need and questions whether we can afford to ensure that we all can live a quality life.

“A one-off 99 percent levy on billionaires’ wealth gains during the pandemic could pay for everyone on Earth to be vaccinated against COVID-19 and provide a $20,000 cash grant to all unemployed workers, according to a new analysis released today by Oxfam, the Fight Inequality Alliance, the Institute for Policy Studies and the Patriotic Millionaires. The organizations are calling on governments to tax the ultra-wealthy who profited from the pandemic crisis to help offset its costs. The one-time emergency COVID-19 billionaire tax would raise $5.4 trillion and still leave the world’s 2,690 billionaires $55 billion richer than before the virus struck. Governments across the world are massively under-taxing the wealthiest individuals and big corporations, which is undermining the fight against COVID-19 and poverty and inequality.”

We cannot keep our political discussion, domestically and internationally, of our challenges and their solutions clouded by an inability or unwillingness to see reality clearly. Defining the “poverty line” with little connection with the real cost of necessities makes things simpler, makes our choices less difficult, and protects those of us who have wealth. But it will not allow us to be the nation we claim to be, nor will it allow us to live in the world we want to live in.

Continuing to allow wealth to be translated into political power does not benefit us. It protects the wealthy. But it does not allow us to solve real problems, make important investments nor protect our future.