Marty Levine

January 7, 2022

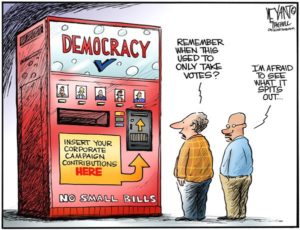

The Right and the left do agree on one thing!

Both agree that it is just stupid to take the high moral ground and not raise money using every back door and loophole they can find. They are both taking advantage of the gaping gaps in rules and regulations that were designed to limit the political power of the wealthy and to keep campaign financing open and transparent. They both are using channels that allow them to blend charitable giving with political spending. And so, right or left, the mechanisms are in place to allow anonymous mega-donors to plow huge sums of money to support candidates and steer public policy to meet their tastes and to profit from their spending.

Consider two 501c3, tax-exempt organizations as our case examples. Both share the same tax status as your community’s United Way, homeless shelter, or community center. All the money donated to them is tax-deductible. But in these cases, the organizations are not about charitable work, they are about a clear political mission.

The New Venture Fund (NVF) politics from the left. Its stated purpose is to “provide operational expertise and support to help change leaders optimize their resources to achieve greater impact—and free them to devote their talents to driving change. We envision a more equitable world, built on fair treatment, access, opportunity, and advancement for all. As changemakers building the most effective charitable projects, we know that advancing race equity, equity, diversity, and inclusion (REDI) is essential to solving our world’s most pressing problems. As such, we dedicate ourselves to integrating REDI into our work and our culture. As we learn more, we will do more — ours is a continuous journey of learning, growth, and innovation.”

Donors Trust comes into the fray from the right. “At Donors Trust our primary focus is on our donors and protecting the donor’s intent. Over time, we have too often witnessed philanthropic capital stray from an original donor’s free-market ideals—the very principles that made their philanthropy possible in the first place. As an antidote to this drift, Donors Trust was established in 1999 as a 501(c)(3) public charity to ensure the intent of donors dedicated to the ideals of limited government, personal responsibility, and free enterprise.”

The New Venture Fund, formed just 16 years ago, raised almost $1 billion in 2020; in the last 5 years NVF brought in $2.5 billion. Donors Trust formed 7 years earlier, raised $350 million in the last year, bringing its total for the last five years to more than $1 billion.. Both are able to provide total anonymity to their donors; both are able to reallocate funds to causes that they support, and both are able to influence the work of government and the campaigns of candidates for public offices. And both are not anomalies. They are examples of what is growing into a tidal wave of large, unregulated political spending.

Both organizations take advantage of IRS rules which allow their organizations to keep the identity of their large donors secret. NVF received two individual gifts of more than $100 million and 6 other gifts larger than $25 million. In total, these 8 individuals were legally able to make tax-deductible contributions of more than $469 million to an organization that is in the business of pushing the nation to the left. For DT, more than 80% of its 2020 revenues came from just 8 donors!

These funds raised as “charities” can then be put into political motion.

The methodology of transferring charity into political action was described in a recent Chronicle of Philanthropy article looking at the rapid growth of the New Ventures Fund: “Under today’s laws and regulations, a rich donor can make a tax-deductible contribution to New Venture — which then can send the money to advocacy groups that do a mix of charity work and election-related activities. In 2020, the New Venture Fund sent $86 million to a political advocacy group called the Sixteen Thirty Fund and $44 million to America Votes, an organization that mobilizes progressive voters to go to the polls.”

Similarly, DF moved more than $28.7 million to The 85 Fund, an organization centered on building “structural limits on government power and the protection of our dignity and our freedoms… through the support of public policy projects that are rooted in those same priorities…” The 85 Fund demonstrates how money moves and wealthy funders exert influence. Senator Sheldon Whitehouse pointed to them as part of a scheme, “selecting judges, funding campaigns for the judges, and then showing up in court in these orchestrated amicus flotillas to tell the judges what to do.”

These are just two organizations among many in an age when we have a growing class of mega-wealthy individuals who have an interest in controlling government policy in their own self-interest. Making their money speak as loudly as they can is valuable to them. Keeping as invisible as possible from the efforts they fund is also valuable. And they have the wealth to engage the attorneys and consultants needed to find the trap doors through which they can avoid unwanted notoriety. They also have the resources to find every opportunity to save a few tax dollars to boot.

As NVF CEO Lee Bodner explained to the Chronicle, all is good as long as everyone, right or left, is playing by “the same set of rules…it’s not up to me to make the rules….”

As reported by the Chronicle, “Rosemary Fei, a lawyer who has represented New Venture Fund for several years and who serves as chair of the American Bar Association’s tax-exempt section, agrees that today’s rules make it more art than science to determine what kind of activities charities and advocacy groups can pursue around election time. “

If we are to protect our democracy and ensure that it is not just the province of the rich, right or left, we do need the rules to be strengthened. There is a need for clarity and higher rules for controlling political spending. We need to ensure that political spending is transparent so we can know who is trying to buy our vote and our legislators. We need to ensure that deductible giving is not used for buying political influence. These are big asks at a time when we struggle to get legislators to agree on what day of the week or what time of the day it is.

But they need to be asked, and policymakers need to be pressed to respond assertively to control political spending.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.