Marty Levine

June 14, 2023

“If I am not for myself, who is for me? But if I am for my own self [only], what am I? And if not now, when?” This teaching, ascribed to Hillel the Elder (Pirkei Avot 1:14) has been a central part of a value system that has pushed me to work for a better, more equitable society.

Unfortunately, we seem to be living in a time when the balance between what is good for me and what is good for us all has swung toward the “me”. Personal benefit, may I say selfishness, seems to be tilting the scales of our nation away from equity.

We can see this struggle between self and community in the decades of debate over federal taxes and government regulations. From the “I am for my own self” perspective “taxes are our money” and anyone trying to take it from us is doing wrong. So, our government should not, those voices say, have the right to tax us when they need to act for the common welfare. They should not have the responsibility to address issues of collective need. If an individual wants to be charitable that’s their decision, but our government should do nothing to address the many issues of equity before us.

In these terms, I can be for myself, and I trust that the silent hand of the free market will take care of everyone else. Believers in the unstoppable force of the free market think that individuals will use their money wisely, and grow the economy and the silent hand of the marketplace will allow its benefits to “trickle down” so everyone will be able to solve their life problems on their own.

Trickle-down economics refers to any policy in which wealthy people and corporations receive tax cuts, stimulus, or deregulation in an effort to boost growth for the entire economy. Also known as supply-side economics, trickle-down economics…Advocates believe it unfetters the free market to produce prosperity…

But, in our real world, it doesn’t work that way.

In 2017, using the rationale of trickle-down economics the Trump Administration and the Republican congressional leadership:

cut the corporate tax rate from 35 percent to 21 percent via the Tax Cuts and Jobs Act of 2017 (TCJA). At the time, the Trump administration claimed that its corporate tax cuts would increase the average household income in the United States by $4,000…

…the Trump administration claimed that corporate tax cuts would ultimately translate into higher wages for workers. The tax cuts would trickle down to workers through a multistep process. First, slashing the corporate tax rate would increase corporations’ after-tax returns on investment, inducing them to massively boost spending on investments such as factories, equipment, and research and development. This investment boom would give the average worker more and better capital to work with, substantially increasing the overall productivity of U.S. workers. In other words, they would be able to produce more goods and services with every hour worked. And finally, U.S. workers would capture the benefits of their increased productivity by successfully bargaining for higher wages.

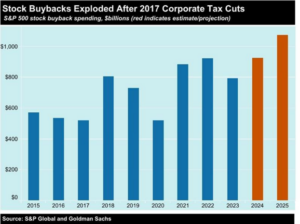

Seven years later, we know that this was not true. Rather than use those savings to boost salaries, invest in more efficient production or in research and development efforts, the savings given to corporations were heavily used to boost executive earnings, pay dividends and increase stock prices by buying up shares of the business. Most of the benefit was given to those who are already the wealthiest, doing little to share the benefit of lower taxes in ways that will have a general, collective benefit.

As noted recently by Common Dreams as it reported on recent research by the Institute for Taxation and Economic Policy (ITEP) that found in its analysis:

that during the first four years after former President Donald Trump’s tax cuts took effect, the country’s largest corporations collectively spent $2.72 trillion repurchasing their own shares—more than they spent “on investments in plants, equipment, or software that might have created new jobs and grown the economy.”

Spending tax-cut windfalls and other profits on stock buybacks siphons resources from worker wages, R&D, and other productive investments that stimulate long-term growth. Analysts have documented the association between buybacks and worker layoffs, as well as reduced capital investment and innovation and wage stagnation.

For those personally benefiting from these failed policies, the money in their pocket can and does get spent on supporting politicians who will vote to keep this policy regime in place.

For example, consider why we continue to resist putting in place a national health system that can ensure that there is affordable, high quality health care available to all. Rather we have a piecemeal approach that is pressured to more and more replace public programs with those managed by for private companies that are the direct beneficiaries of low taxes. The nation’s oldest public health insurance program, Medicare, has slowly morphed from a single-payer program for all seniors to one with two options, the traditional Medicare program and a second, Medicare Advantage, run by for-profit insurance companies which have lobbied long and hard to allow them to profit at the expense of those they serve and the national as a whole.

According to Jake Johnson, (Common Dreams), we can see how inefficient the use of public funds is and how profitable it is for private insurers.

A new academic analysis published Monday in JAMA Internal Medicine details the enormous sums that privatized Medicare Advantage plans have cost U.S. taxpayers in recent years and calls for the abolition of the program, which has been massively profitable for the insurance giants that dominate it.

Citing the nonpartisan Medicare Payment Advisory Commission, the paper notes that Medicare Advantage (MA) plans have overcharged the federal government to the tune of $612 billion since 2007—and $82 billion last year alone.

… MA plans spend 9% less on medical services than [fee-for-service] Medicare spends for comparable enrollees…overhead and profit eats up the lion’s share.

Wendell Potter, a former insurance executive who has become a trenchant critic of Medicare Advantage, told Common Dreams how this interplay of lobbying and personal enrichment works

Not only has it never saved taxpayers a dime since it was created during the George W. Bush administration, but it has cost us $592 billion over the last 17 years because of the high administrative costs inherent in the program and the way insurers have rigged the system to get paid excessively every year

The program is so entrenched, and the companies have so much political influence over Democrats as well as Republicans through campaign contributions and lobbying, that eliminating the program will be a heavy lift, at least in the near term,” Potter added. “That means that proposals to reform MA that address overpayments and abuses like prior authorization are essential and important for reform advocates to support.

Profits benefit individual owners and provide the funds that allow the industry to spend heavily on lobbying and campaign contributions to ward off any attempts to eliminate a bad and expensive program

The Hill documented what occurred last year when Biden tried to take some of these excess profits away through tighter regulation Administration.

When the White House began discussing changes to the Medicare Advantage payment model last year, the health insurance industry launched a multimillion dollar lobbying campaign against the proposed changes…The Better Medicare Alliance (BMA), a group funded by multiple major insurance companies, ran Super Bowl ads warning that the White House was planning to cut Medicare…The American Action Network, a House-GOP aligned advocacy group that previously received millions of dollars from health care interests, including Aetna, a Medicare Advantage provider, launched $2 million in ads …putting pressure on swing-district Democrats to oppose Biden’s plan…America’s Health Insurance Plans (AHIP)… AHIP spent $13.3 million on lobbying last year…

The focus on the personal over the community seems to play out whenever there are attempts to increase taxes or change regulations that increase our collective ability to meet our national needs and raise the funds needed to do that. Those who wish to protect their own back yards and pocketbooks seem to have the ascendency in this political moment. Our national government is at best stalemated from acting on the common good.

The election coming this November gives us a chance to change this picture. But only if we elect candidates who have not been seduced by the power of money and personal interest.

Your writing is like a breath of fresh air in the often stale world of online content. Your unique perspective and engaging style set you apart from the crowd. Thank you for sharing your talents with us.

Somebody essentially lend a hand to make significantly articles I’d state. That is the very first time I frequented your website page and up to now? I surprised with the research you made to make this actual submit amazing. Wonderful task!