Marty Levine

May 18, 2023

In case you missed it, the New York Times spotlighted how troubled our nation’s economy is last Sunday. This was not a story about the harmful effects of inflation, nor was it a story about the lingering impact of the COVID pandemic, the job market or the nation’s looming debt default. It was a story about the wealth of our nation that illustrated how we are a nation with a small slice of very wealthy people and the rest of us who live with limited or no financial resources. And it was a story about how this advantaged minority is about to pass their privilege on to their children and grandchildren.

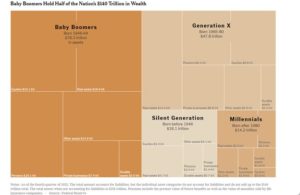

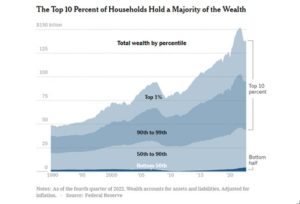

This was a story about the more than 80 million Baby Boomers, (those born between 1946 and 1964), among whom I count myself, who have as a group reaped the economic benefits of a growing economy and of a system that allowed wealth to be accumulated and retained. “In 1989, total family wealth in the United States was about $38 trillion, adjusted for inflation. By 2022, that wealth had more than tripled, reaching $140 trillion. Of the $84 trillion projected to be passed down from older Americans to millennial and Gen X heirs through 2045, $16 trillion will be transferred within the next decade.”

But, in a very American manner, this wealth is not distributed equally. “Most will leave behind thousands of dollars, a home or not much at all. Others are leaving their heirs hundreds of thousands, or millions, or billions of dollars in various assets…High-net-worth and ultrahigh-net-worth individuals — those with at least $5 million and $20 million in cash or easily cashable assets — make up only 1.5 percent of all households. Together, they constitute 42 percent of the volume of expected transfers through 2045, according to the financial research firm Cerulli Associates. That’s about $36 trillion as of 2020 — numbers that have most likely increased since.”

This last paragraph is worth thinking deeply about.

When I was in Junior High School, I thought that I would be earning $8,000 a year when I became an adult. I grew up in what I thought was an average, middle-class home. My Mother did worry about the family budget but only in reference to her fear that we might have to live through a 2nd Great Depression. I grew up in a family without worrying about having the rent paid, or food to eat, or clothes to wear. I didn’t think much about money or the need to get a job to help my working parents out.

When I left home, I took with me my education, a used car, and very little else. I worked, earned my salary and, like my parents, was able to pay rent, buy food and live a comfortable life.

In the last years of his life, my father-in-law, a man I always thought of as wealthy, proudly shared the details of his investment portfolio with my wife and I. He smiled as he reflected that he “was a millionaire”. He and his wife had lived a rich life. They had raised their children in a comfortable home they had purchased. They ensured their children all had quality educations. They were engaged in their community and were philanthropic. All of that without having crossed the $5 million threshold and been numbered among the favored 1.5%.

Several years ago, when my wife and I neared the end of our working years and neared our own retirement, we sat down with a financial planner to review our own financial situation for the years when we would not have regular salaries to live on. I was surprised and pleased to see we had assets that were also over that $1 million marker. But we too did not “merit” being counted among the richest 1.5% of our generation.

This outcome was not the result of our “merit” or hard work, alone. Fortunately, we had just enough money to make a small down payment on a new home in Houston Texas when I took a job there and we saw its value grow enough in the less than four years, we owned to it to allow us to buy a $65,000 home in Chicago when we moved there. And that home had grown to a value of more than $350,000 when we sold it a few years ago. Along with providing us with a place to live, and build a family and a community, these homes gave us a chance to accumulate some of the assets we would need in these later years of life. The steadily growing stock market along with jobs that gave us pensions and retirement accounts also favored us with the ability to grow our wealth.

Having had the resources we had, I know that I am living a privileged life. We have resources that allow us to live an easy life. Our financial worries are about the cost of travel and opera tickets, not about an unexpected $400 bill or the price of rent. We have the luxury of being a donor to causes we feel are “worthy.” I know that we are fortunate and have a level of comfort and security that is not universal.

So, if we are living so well, what is the need for the great wealth that a small fraction of our population has been allowed to amass?

The passing of great wealth from generation to generation is just a way to further concretize a society that divides and separates rich from poor, which makes it less and less possible for us all to live comfortable lives. The inability to acquire wealth through property and investment earnings have been features of our racially discriminatory nation.

We can see this feature in the way this hoarded wealth is then used to invest politically to maintain the system as it is, to prevent elected officials from passing systemic changes to our tax codes that would both expand public services and limit the amount of wealth hoarding possible.

Those with great wealth are using it to build legal ways, as philanthropic and “charitable” donors, to lock the economic status quo in place. Consider this data compiled by Americans for Tax Fairness: “In 2008, the last election year before the ruling, billionaires contributed a relatively modest $31 million to federal campaigns. By 2020, their donations had ballooned to $1.2 billion, a nearly 40-fold increase. In the 2020 election cycle, billionaires contributed nearly $1 out of every $10, while making up just 0.01% of all donors contributing more than $200. “

Fueling this investment are Billionaires like Barre Seid who donated almost $2 billion to establish, a described by the NY Times, to form a new political force “The organization, Marble Freedom Trust, was formed in 2020 and was funded by a gift of more than $1.6 billion — an extraordinary windfall that resulted from a single donor’s contribution of 100 percent of a company’s shares before the company was sold, leaving Marble with the proceeds of the sale, The New York Times reported last year.”

Here’s how the NY Times described what Seid’s generosity allowed in just one election cycle when this“ deep-pocketed nonprofit organization founded by the conservative activist Leonard A. Leo gave away $182.7 million in a year’s time, a new tax filing shows, demonstrating how aggressively it has worked behind the scenes to prop up other groups and causes on the right.

We need to break the cycle that allows fortunes of that would allow, according to the Times, “The trillions of dollars going to heirs will largely reinforce inequality. The wealthiest 10% of households will be giving and receiving a majority of the riches. Within that range, the top 1%—which holds about as much wealth as the bottom 90%, and is predominantly white—will dictate the broadest share of the money flow. The more diverse bottom 50% of households will account for only 8% of the transfers.”

Its time to change our tax laws so that great wealth is taxed and used for common benefit.